Ftse 100 Average Pe Ratio

The PE ratio reached an all-time high of 34210 in Sep 2016 and a record low of 7410 in Mar 2009. FTSE 100 PE 1645.

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

Looking at the FTSE 100 PE ratio should give a snapshot of how expensive the UK stock market is at any one moment but in actual fact the FTSE 100s PE ratio has fluctuated greatly over time.

Ftse 100 average pe ratio

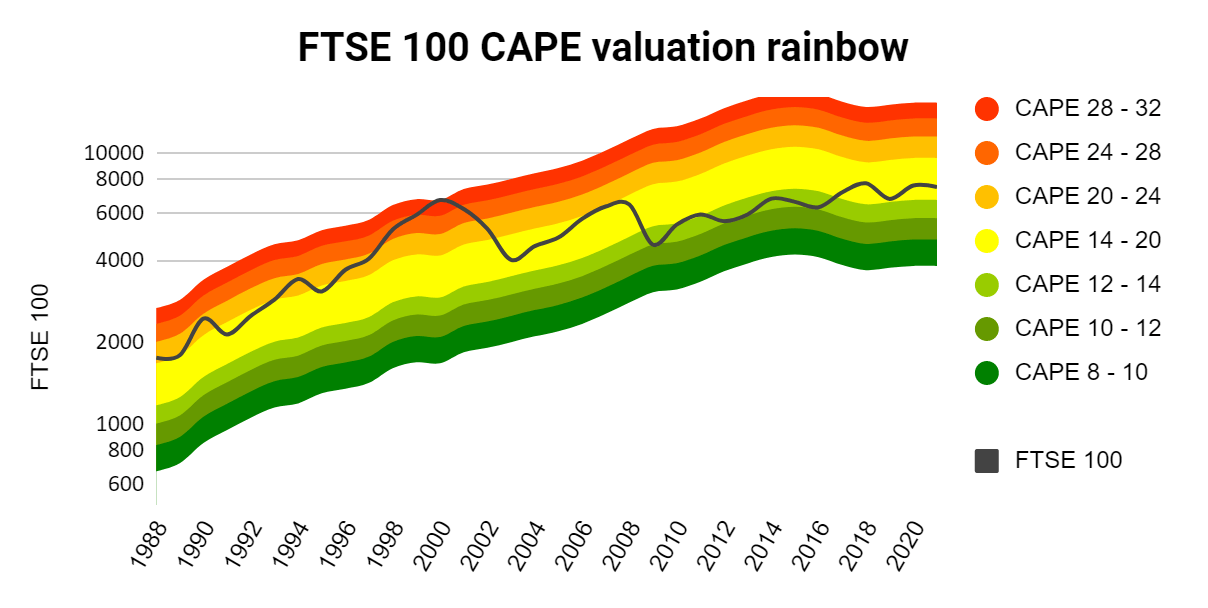

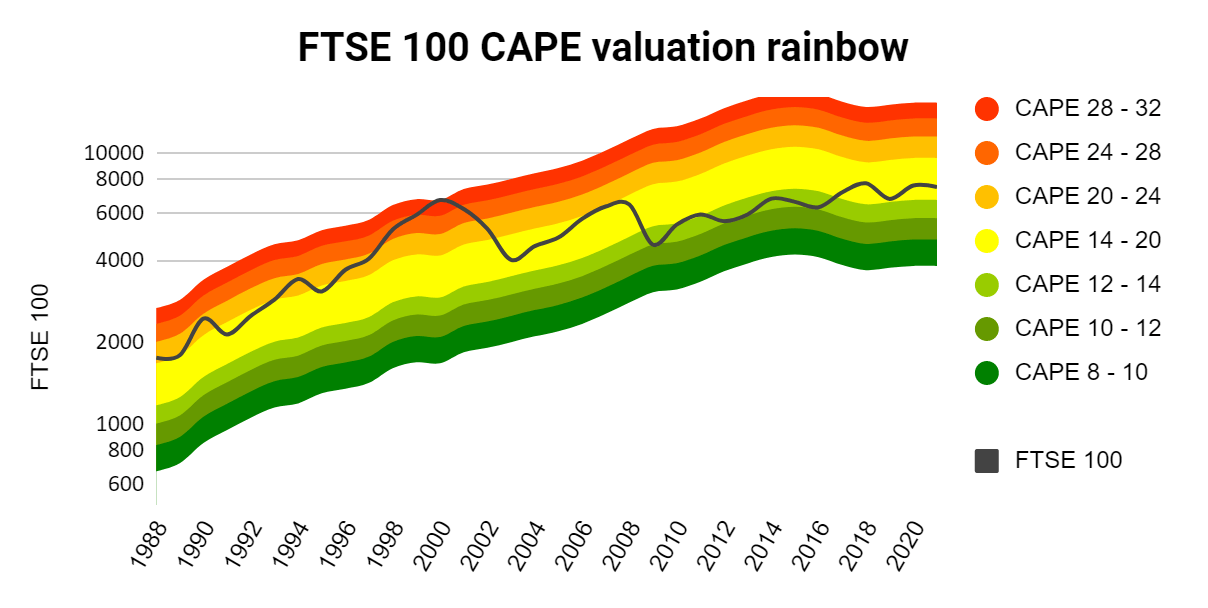

. South Africa PE Ratio. What is the FTSE 100 PE ratio. The ratio varies with earnings but they can fluctuate massively and tell us little about the underlying story. So lets just say the FTSE 100s CAPE has averaged 16 over the very long-term and its ranged between 10 and 34 over the last 33 years.Industrials data was reported at 13002 NA in Nov 2018. Today the FTSE 250 is at 20064 and its CAPE ratio is 258 which means its cyclically adjusted earnings are equal to 776 index points. From there its easy to calculate the FTSE 100s earnings for 2019. The FTSE 100s pe ratio is 33 the historical average is 15.

At current prices RBS trades on a forward PE ratio of 92 times. The data reached an all-time high of 19820 NA in Jan 2018 and a record low of 3131 NA in Aug 2016. FTSE 100 2019 earnings 7542 1645 4585 index points. Since the FTSE 100s CAPE ratio is pretty much spot on on its long-term average of 16 and because theres no obvious reason to expect it to go shooting off towards 32 as it.

FTSE 100 2019 earnings 7542 1645 4585 index points. Using this method the stocks that make up the FTSE 100 now look less attractive than a few months ago their average pe ratio is now 136 compared with. South Africa PE Ratio. 107 Zeilen FTSE 100.

The FTSE Russell provides daily PE Ratio. In the latest reports the FTSE 100 closed at 6969815 points in Apr 2021. However today Im looking at two FTSE 100 stocks that currently trade on PE. In the background most rationale people can see that we are in due for a massive.

84 Zeilen UKs PE ratio is updated daily with historical data available from Jun 1993 to Aug 2021. Buy Aviva AV by Deutsche Bank. Industrials data is updated monthly averaging 15267 NA from Apr 2013 to Nov 2018 with 68 observations. FTSE 100 price 7542.

The FTSE 100 has a trailing PE ratio of around 16. The next thing we need is CPI inflation for 2019 which we can get from the Office for National Statistics website. The lower the ratio the cheaper the stock is and many consider a PE ratio of 15 to be an average valuation. Is the FTSE 100 expensive.

According to the ONS CPI inflation in 2019 was 17. With the FTSE 100 at 7100 its CAPE ratio stands at 158 fractionally below that long-term average of 16. PE ratio The price-to-earnings ratio compares a companys share price with its earnings. The large-cap index has repeated hit all-time highs during 2017 and at a current price of 7550 it sits only a few points below its highest ever closing value of 7562.

FTSE 100 Index financial information fundamentals and company reports including full balance sheet profit and Loss debtors creditors financial ratios rates margins prices and yields. This records a decrease from the previous number of 13975 NA for Oct 2018. When its reached that level in the past it has. FTSE 100 price 7542.

This is why many investors think the index is expensive. South Africa PE Ratio. So are shares hugely overvalued. The FTSE 100 PE ratio is a way of comparing the index price to its underlying earnings.

This sits comfortably below the Footsie broader average of around 145 times. On top of that for 20 years or so the FTSE 100 has repeatedly failed to sustainably exceed 7000. Buy PureTech Health PRTC by Liberum Capital. FTSE 100 PE 1645.

From there its easy to calculate the FTSE 100s earnings for 2019. Inflation is currently indexed to 100 points in 2015 and. Now we face an existential crisis where physically normal activity is no longer possible. The FTSE 100 PE ratio presently stands at 15 and the FTSE 350 an aggregation.

The banks corresponding dividend yield of. I am not sure this measure means an awful lot this reading can vary enormously a year ago it was at just 11 two years ago at 22. And in this case takes an average for the whole stock market.

The Ultimate Ftse 100 Guide Shares Magazine

The 17 6 Year Stock Market Cycle Historic Ftse 100 Trailing Price Earnings Pe Ratio Updated 07062017

What Is The Ftse 100 P E Ratio And Does It Really Matter Ig Uk

Exactly Why Is The Ftse 100 Index No Higher Than Nearly 20 Years Ago Investing Forums Citywire Funds Insider Forum

The 17 6 Year Stock Market Cycle April 2014

Ftse 100 Cape Valuation And Long Term Forecast Seeking Alpha

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

Now we face an existential crisis where physically normal activity is no longer possible. Is the FTSE 100 expensive.

Ftse 100 Cape Valuation And Long Term Forecast Seeking Alpha

On top of that for 20 years or so the FTSE 100 has repeatedly failed to sustainably exceed 7000.

Ftse 100 average pe ratio

. However today Im looking at two FTSE 100 stocks that currently trade on PE. Inflation is currently indexed to 100 points in 2015 and. The FTSE Russell provides daily PE Ratio. In the latest reports the FTSE 100 closed at 6969815 points in Apr 2021.South Africa PE Ratio. South Africa PE Ratio. This records a decrease from the previous number of 13975 NA for Oct 2018. With the FTSE 100 at 7100 its CAPE ratio stands at 158 fractionally below that long-term average of 16.

In the background most rationale people can see that we are in due for a massive. From there its easy to calculate the FTSE 100s earnings for 2019. The FTSE 100s pe ratio is 33 the historical average is 15. FTSE 100 PE 1645.

Today the FTSE 250 is at 20064 and its CAPE ratio is 258 which means its cyclically adjusted earnings are equal to 776 index points. According to the ONS CPI inflation in 2019 was 17. FTSE 100 2019 earnings 7542 1645 4585 index points. This is why many investors think the index is expensive.

107 Zeilen FTSE 100. Buy Aviva AV by Deutsche Bank. This sits comfortably below the Footsie broader average of around 145 times. FTSE 100 Index financial information fundamentals and company reports including full balance sheet profit and Loss debtors creditors financial ratios rates margins prices and yields.

So lets just say the FTSE 100s CAPE has averaged 16 over the very long-term and its ranged between 10 and 34 over the last 33 years. At current prices RBS trades on a forward PE ratio of 92 times. Industrials data was reported at 13002 NA in Nov 2018. The ratio varies with earnings but they can fluctuate massively and tell us little about the underlying story.

The FTSE 100 has a trailing PE ratio of around 16. FTSE 100 price 7542. Using this method the stocks that make up the FTSE 100 now look less attractive than a few months ago their average pe ratio is now 136 compared with. Industrials data is updated monthly averaging 15267 NA from Apr 2013 to Nov 2018 with 68 observations.

When its reached that level in the past it has. So are shares hugely overvalued. The next thing we need is CPI inflation for 2019 which we can get from the Office for National Statistics website. South Africa PE Ratio.

The FTSE 100 PE ratio presently stands at 15 and the FTSE 350 an aggregation. FTSE 100 2019 earnings 7542 1645 4585 index points. From there its easy to calculate the FTSE 100s earnings for 2019. Buy PureTech Health PRTC by Liberum Capital.

The FTSE 100 PE ratio is a way of comparing the index price to its underlying earnings. What is the FTSE 100 PE ratio. Since the FTSE 100s CAPE ratio is pretty much spot on on its long-term average of 16 and because theres no obvious reason to expect it to go shooting off towards 32 as it. The banks corresponding dividend yield of.

The data reached an all-time high of 19820 NA in Jan 2018 and a record low of 3131 NA in Aug 2016. PE ratio The price-to-earnings ratio compares a companys share price with its earnings. The large-cap index has repeated hit all-time highs during 2017 and at a current price of 7550 it sits only a few points below its highest ever closing value of 7562. And in this case takes an average for the whole stock market.

84 Zeilen UKs PE ratio is updated daily with historical data available from Jun 1993 to Aug 2021. I am not sure this measure means an awful lot this reading can vary enormously a year ago it was at just 11 two years ago at 22. FTSE 100 price 7542. The lower the ratio the cheaper the stock is and many consider a PE ratio of 15 to be an average valuation.

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

The 17 6 Year Stock Market Cycle April 2014

The Ultimate Ftse 100 Guide Shares Magazine

What Is The Ftse 100 P E Ratio And Does It Really Matter Ig Uk

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

Valuations Have Fallen Sharply But Buyers Beware Ftse Russell

The 17 6 Year Stock Market Cycle Historic Ftse 100 Trailing Price Earnings Pe Ratio Updated 07062017

Exactly Why Is The Ftse 100 Index No Higher Than Nearly 20 Years Ago Investing Forums Citywire Funds Insider Forum

Posting Komentar untuk "Ftse 100 Average Pe Ratio"